Choosing a business structure relies on your tolerance for risking your personal assets among many factors.

Designing a killer website, prototyping your product, talking your way to your first big order — these parts of starting your business likely stir your entrepreneurial passions.

The business structure of your new enterprise? Not so exciting.

But hold on. Careful consideration of which structure is right for you is crucial because it will have implications for how the IRS taxes your business profits. It’ll also determine whether your personal property is protected when others demand money from your business. Other considerations, including the management of the new business and your long-term plans for it, come into play as well

Below, we’ve outlined types of business structures and what to consider before choosing one.

Business structure options

Business structures are largely creations of state law, so there are minor variations on the details from state to state. Here are five common models:

Sole proprietorship

An unincorporated business is owned by one person who reports business profits on his or her individual tax return. A sole proprietorship is the simplest business structure and is straightforward to start.

Partnership

An unincorporated business owned by multiple owners, either people or other businesses. Profits are divided among its owners and reported on their tax returns. Common partnership types include general partnerships, limited partnerships, limited liability partnerships (LLPs), and limited liability limited partnerships (LLPs).

Limited liability company (LLC)

An LLC is a hybrid business structure that limits the personal liability of its owners — called members — like a corporation but allows the profits to be taxed on either a member level or the corporate level.

S corporation

An S corporation has one class of stock and no more than 100 shareholders, none of whom can be another for-profit business or a person without a green card who doesn’t meet IRS residency requirements. Profits are taxed on shareholders’ tax returns, and shareholders have limited liability.

C corporation

A corporation whose profit is taxed once on the business level and a second time on an individual basis when earnings are distributed to shareholders, who have limited liability for the business’s debts. C corporations can have multiple classes of stock and an unlimited number of shareholders.

Switching business structures is possible, but it’s best to decide early on which one you’ll need for the next few years. It can get complicated — not to mention pricey, in terms of legal fees — to change structures, and the effort could distract from running your business.

Choosing your business structure: What to consider

What’s your tolerance for risk to personal assets?

When you run a business, you’re at greater risk for a lawsuit. Why? Businesses interact with the world — other businesses, government, regular people — much more than most individuals, and when they do, there’s good chance money’s involved.

In a sole proprietorship, if your business is sued and loses, your personal assets — real estate, cars, bank accounts — can be targets for the parties seeking to collect damages. The same can be said, in some cases, if you default on a business loan and you signed a personal guarantee, or the lender-placed a lien on your assets. The lender can attempt to recover its investment from your personal property.

In a general partnership, creditors can go after any of the partners’ personal assets to recoup the whole debt. It’s different in a limited partnership, where only the general partners are personally liable for the debts of the business, while limited partners are liable for the business’s debts only up to the amount of their investment. More common among lawyers are limited liability partnerships, which limit partners’ liability for the firm’s debts but still hold them individually liable for their professional activities. There are also limited liability limited partnerships, a sort of limited partnership that extends limited liability to general partners, not just limited partners.

LLCs and corporations limit their members’ or shareholders’ liability, so personal assets are protected.

How do you want the IRS to tax your business profits?

Sole proprietorships, partnerships, and S corporations are pass-through entities, as are some LLCs. In a pass-through entity, profits are passed directly to the owners of the business. Come tax time, it is reported on the owners’ individual returns.

By default, the IRS views LLCs as pass-through entities unless they opt to be taxed as a corporation.

C corporations are separate entities from their owners, so their profits are taxed at the corporate level. If a corporation pays out dividends, which come out of its after-tax income, shareholders also must pay taxes on their proceeds.

How formal do you want your management structure to be?

If multiple owners are involved, structuring the business can be more complicated.

Partnerships are typically governed by agreements that specify how profits from the business are divided among parties and what happens when a partner retires, becomes disabled, declares bankruptcy, or dies.

An S corporation or C corporation is required by law to have a board of directors to oversee the company’s direction on behalf of the shareholders.

An LLC structure generally allows the choice between being managed by members or overseen by a management team, which can include members or nonmembers. LLCs typically draw up an operating agreement that specifies roles.

How much administrative complexity can you handle?

For noncorporation business structures, initial paperwork and fees are relatively light and are simple enough for owners to handle without special expertise (though it’s a good idea to consult a lawyer or an accountant for help). Ongoing requirements usually come on an annual basis.

For S and C corporations, the administrative complexity increases, and you will almost certainly need a lawyer and accountant. In every state, there are tax and legal hoops to jump through for corporations to become and remain compliant. Failure to meet deadlines, pay certain fees and file the proper forms can result in penalties.

What are your long-term goals for the business?

The right structure doesn’t just depend on the state of your business today; it also depends on where you would like to be in three to five years, or even longer.

If you’re looking for fast growth, which takes cash, C corporations allow for multiple classes of stock and don’t restrict the number or type of shareholders. They’re the best fit if you’re seeking investments from venture capitalists, or if you plan on becoming a publicly-traded company, rather than a privately owned one, in the near- or mid-term.

Another consideration is what happens when you or another owner dies, goes bankrupt, or withdraws. Corporations live on after these events, but generally, the other types of business structure dissolve unless specified otherwise beforehand.

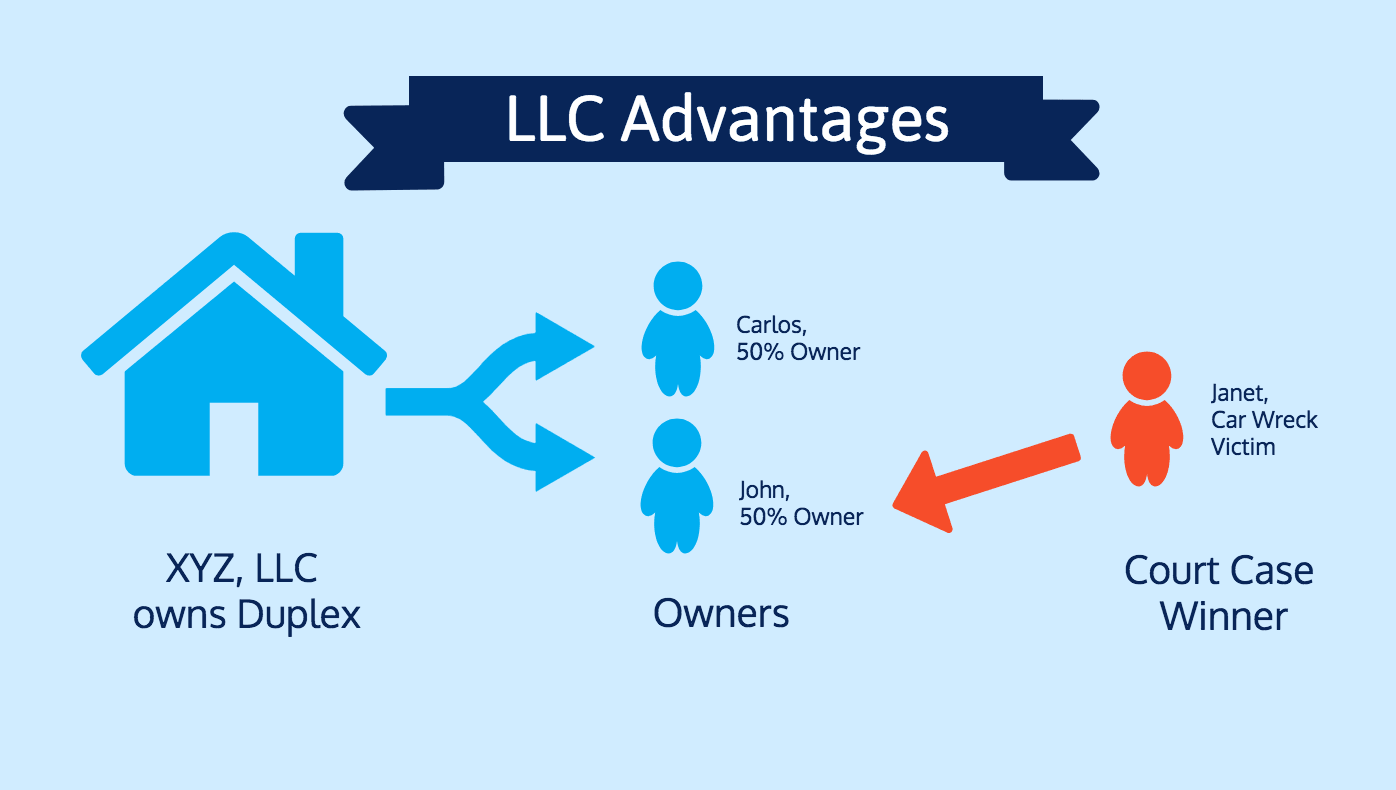

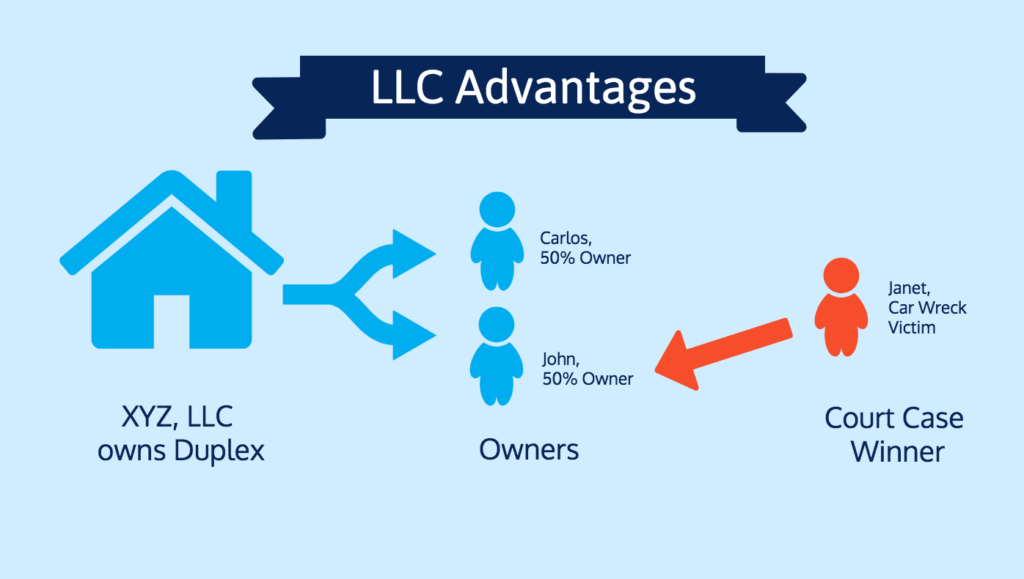

Advantages of an LLC

Here are six of the reasons that limited liability companies have become a popular choice for small businesses.

- Limited Personal Liability

If your business is a sole proprietorship or a partnership, you and your business are legally the same “person.” Your business debts are also your personal debts. And if your business partner or employee is accused of negligence, your personal assets might be at risk.

An LLC limits this personal liability because an LLC is legally separate from its owners.

- Less Paperwork

Corporations also offer limited liability, but they have to observe certain requirements that may not be well suited to a small, informally run business. For instance, corporations typically must hold annual shareholder meetings, make annual reports and pay annual fees to the state. They also tend to have substantial recordkeeping requirements.

- Tax Advantages of an LLC

LLCs get the best of all worlds when it comes to taxation. LLCs don’t have their own federal tax classification but can adopt the tax status of sole proprietorships, partnerships, S corporations, or C corporations.

- Ownership Flexibility

S corporations enjoy pass-through taxation, but they have several ownership restrictions. For example, they can’t have more than 100 shareholders, can’t include foreign shareholders, and can’t have shareholders that are corporations. LLCs provide pass-through taxation without any restrictions on the number and type of owners they can have.

- Management Flexibility

Corporations have a fixed management structure that consists of a board of directors that oversees company policies and officers who run the day-to-day business. Owners, also known as shareholders, must meet every year to elect directors and conduct other company business.

LLCs don’t have to use this formal structure, and an LLC’s owners have more choices about the way they run the business and make decisions.

- Flexible Profit Distributions

LLCs have flexibility in the way they distribute profits to their owners, and they aren’t required to distribute them equally or according to ownership percentages. For example, two people may have equal interests in an LLC, but they may agree that one of them will receive a greater share of the profits because he or she contributed more money or labor in the business’s startup phase.

Corporations, on the other hand, must distribute profits to shareholders according to the number and types of shares they hold.

An LLC’s simple and adaptable business structure is perfect for many small businesses. While both corporations and LLCs offer their owners limited personal liability, owners of an LLC can also take advantage of LLC tax benefits, management flexibility, and minimal recordkeeping and reporting requirements.