Whether you are a US resident or non-resident, You’ll need basic information about yourself and your business, as well as legal business documentation.

When you decide to open a business bank account online, you’ll need to provide basic details about yourself, your business, and any additional business owners. You’ll also need a government-issued ID and legal business documentation.

Here are the requirements to open a business bank account and what you can expect during the process.

Prepare your information and documents

You can open a business bank account online or in-person at a branch location, depending on the bank. You’ll likely provide the same information for both, but, brick-and-mortar banks may require additional details or documentation.

Requirements also may vary based on your entity type and the state where you formed your business.

Here’s a list of what you’ll need to open your business bank account:

Personal details: Your name, birth date, mailing address, contact information, Social Security number, and ownership percentage in your business. For some online-based business bank accounts, you may need to use an email address or phone number to create your account before you can complete an application.

Personal identification: A government-issued photo ID, such as a driver’s license or passport. If your business has multiple owners, you typically need to include personal details and identification for every owner with 25% or more ownership in the business.

Business details: Your business name, DBA or trade name (if applicable), employer identification number (EIN), business address, entity type, and industry/type of business.

If your business is a sole proprietorship or single-member LLC, you may not be required to provide an EIN, as long as you provide your Social Security number.

Business documentation: What you’ll need to provide ultimately depends on your entity type and the state where your business was established. Here are the documents you might be asked for based on your business entity:

- Sole proprietorships: EIN, business name registration certificate, a business license.

- Partnerships: Partnership agreement, business name registration certificate, business license, state certificate of partnership.

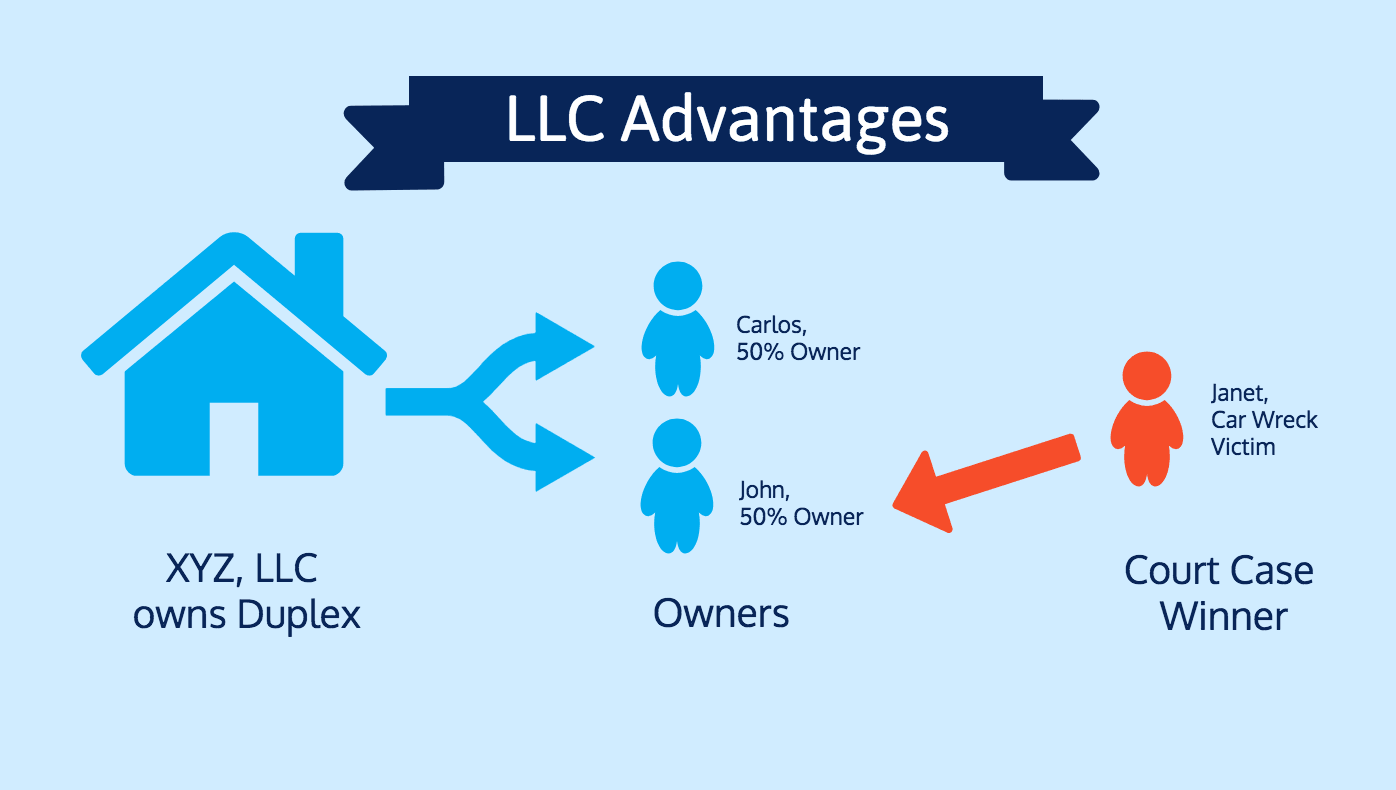

- LLCs: Articles of organization, LLC operating agreement, a business license.

- Corporations: Articles of incorporation, corporate bylaws, a business license.

Banks may have slightly different verification requirements. Review all instructions carefully when it comes to submitting your business documentation.

Opening deposit: Can range from $0 to $1,000. Some banks have started to waive minimum opening deposits, but many still require it.

Choose a business bank account

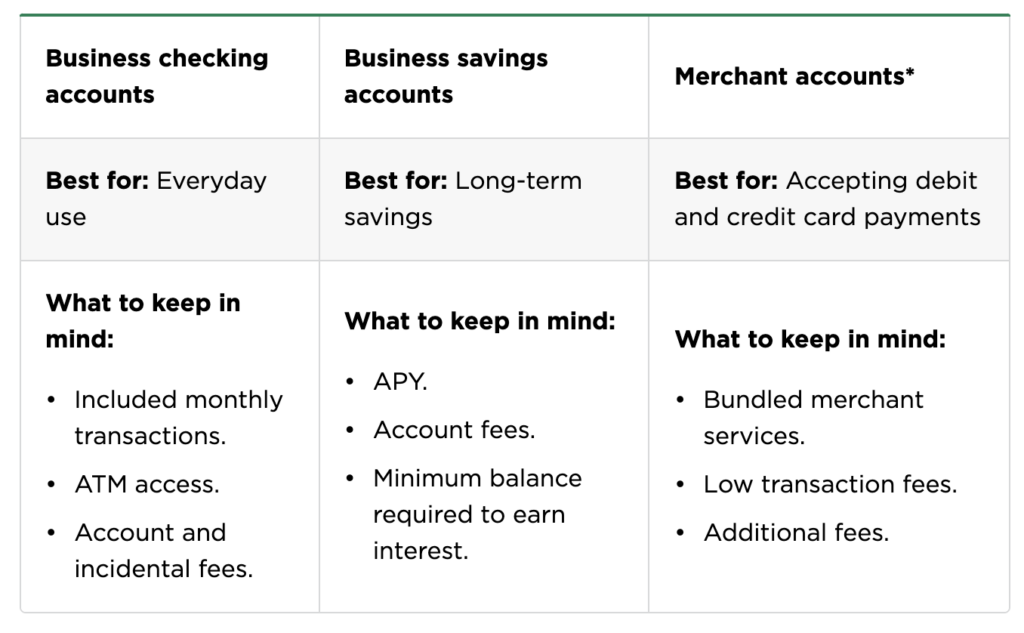

Before you can open a business bank account, you’ll want to compare options to find an account that best suits your financial needs. Consider what type of business bank account you need, whether you’re interested in an online-only account and how you want to open your account (online vs. in-person).

Types of business bank accounts, compared

*Merchant accounts are specialized business bank accounts used for accepting debit or credit card payments. You need to open a business checking account before you can get a merchant account.

While exploring business bank account options, you also will want to think about:

- Monthly fees.

- Minimum balance requirements.

- Included fee-free transactions.

- ATM access (withdrawals and deposits).

- Wiring, transfer, and payment capabilities.

- Incidental fees (stop payment, nonsufficient funds, overdrafts).

- Online and mobile banking.

- Additional features, such as bill pay, invoicing, or integrations with other business tools.

Open a business bank account for non-residents

You’ll likely be able to open your business bank account in just minutes, especially if you’re signing up online and have gathered your documentation ahead of time.

After you’ve submitted your application, banks generally need from one to seven business days to review it. Once you’re approved, you can finish setting up your business bank account by transferring funds, adding users, signing up for online and mobile banking, and more.

Benefits to open a business bank account

90% of businesses fail because they can’t collect funds from customers, to build a complete business and have great products are not enough as you will be stuck in collecting payments in a way that gives your customer trust.

It’s will be easy later to integrate Stripe with your site receive payments-especially if your services based on a recurring basis, further you will open business PayPal safely for your business, and now the time to grow your revenue

If you are non-resident, have your Company formed in the US, and acquire to open a Business Bank Account to start selling!!, contact us;